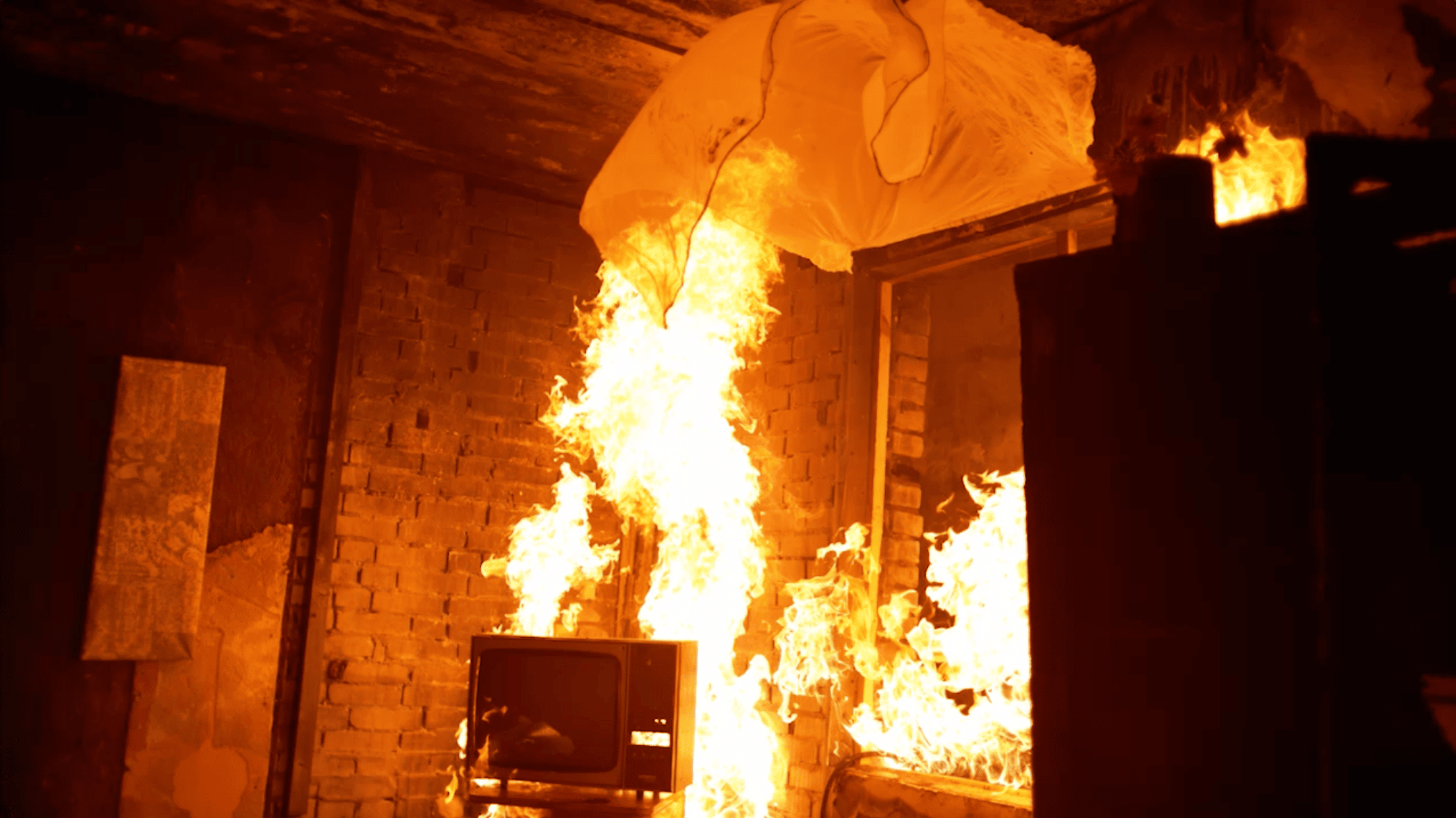

Fire and Smoke Damage Claims

Almost a quarter of all homeowner’s insurance claims each year are the result of fire or smoke damage.

Almost a quarter of all homeowner’s insurance claims each year are the result of fire or smoke damage. Damage from fire and smoke is relentless, and frequently leaves very little trace of the items we once loved. Everything from the fabric in our clothing, to jewelry and precious goods, to the irreplaceable memories and keepsakes in our lives are frequently lost or damaged each year in fires and smoke.

Having to battle an insurer that will not properly pay a claim following a fire only exacerbates the frustrations a policyholder may experience. Daly & Black has handled hundreds of such claims across the country and knows how to protect your rights and ensure you are fully compensated following a fire and/or smoke damage loss.

As is the case with most losses, we strongly suggest to our policyholders that they take certain steps following such a loss:

- Document any damages to your property by taking clear photographs. Be sure to document any smoke damage, as best you can. Use a high-quality camera phone or other such device to take photos and video of all items you believe have been affected.

- Consult with an independent adjuster or damage or remediation expert to obtain an unbiased opinion on the scope of the loss, and potential damages you are facing.

- Keep track of any receipts or expenses regarding home repairs, mitigation efforts, replacement of items, or any other expense relating to the loss. We recommend tracking such items in a spreadsheet.

Almost a quarter of all homeowner’s insurance claims each year are the result of fire or smoke damage.

After a claim is made, insurers may look for reasons to deny the claim or underpay it. In our experience, insurers may use a handful of reasons to deny or underpay a claim such as:

- Accusations of arson.

- Differences in opinion over the value of items to be replaced or repaired.

- Other possible violations of the insurance policy.

Smoke damage, and the remediation of items impacted by smoke, is particularly tricky. The fine particles that make up smoke can lodge themselves into your skin, eyes, or respiratory system and create several health issues. These same particles can become trapped in clothing, rugs, carpeting systems, and other fabrics, leaving behind a permanent odor if not treated or replaced. This is an area frequently seen as a battle ground for insurers looking to underpay legitimate claims of damage. For example, smoke damage may cause discoloration in marble, tile, and other foundational materials. But insurers will often pay for cleaning services, and refuse to pay to replace the foundational material even though the policy may require replacement.

It is important to have third party, unbiased, experts perform a thorough inspection of your property after sustaining fire and smoke damage. This requires a skilled eye, as you do not want to overlook and therefore exclude any items that have been damaged from the claim. Similarly, it is essential to have an independent damage assessment done of any structural steel or iron, stucco, siding or concrete, windows, plumbing and heating systems, and any interior walls/framing that remain following the fire.

If your home or property was damaged by fire and/or smoke, we strongly recommend you contact one of our skilled national policyholder lawyers at Daly & Black, P.C. Consultations are always free, and we collect a fee only if we are successful in getting your claim properly and fully paid.